Report Highlights

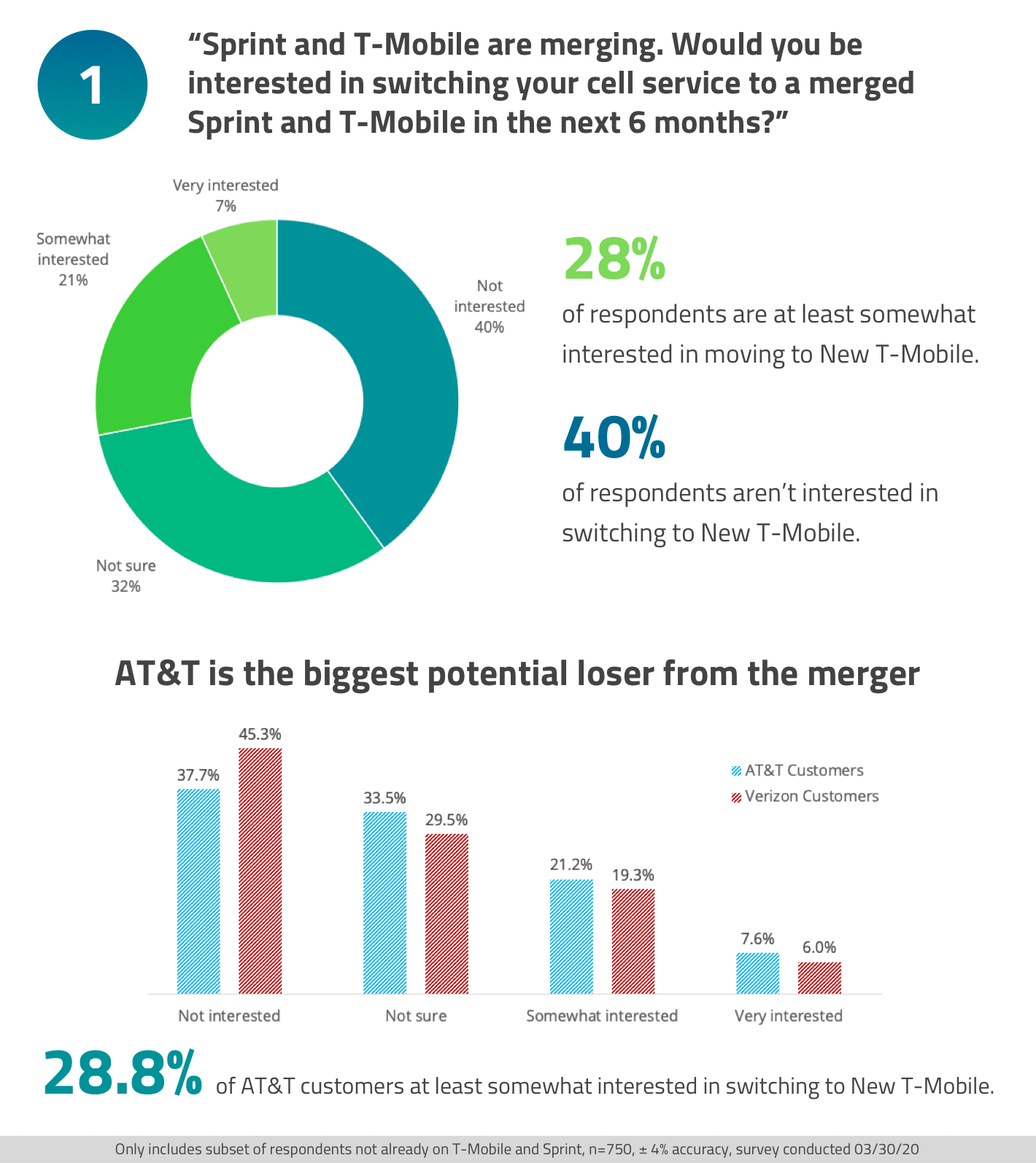

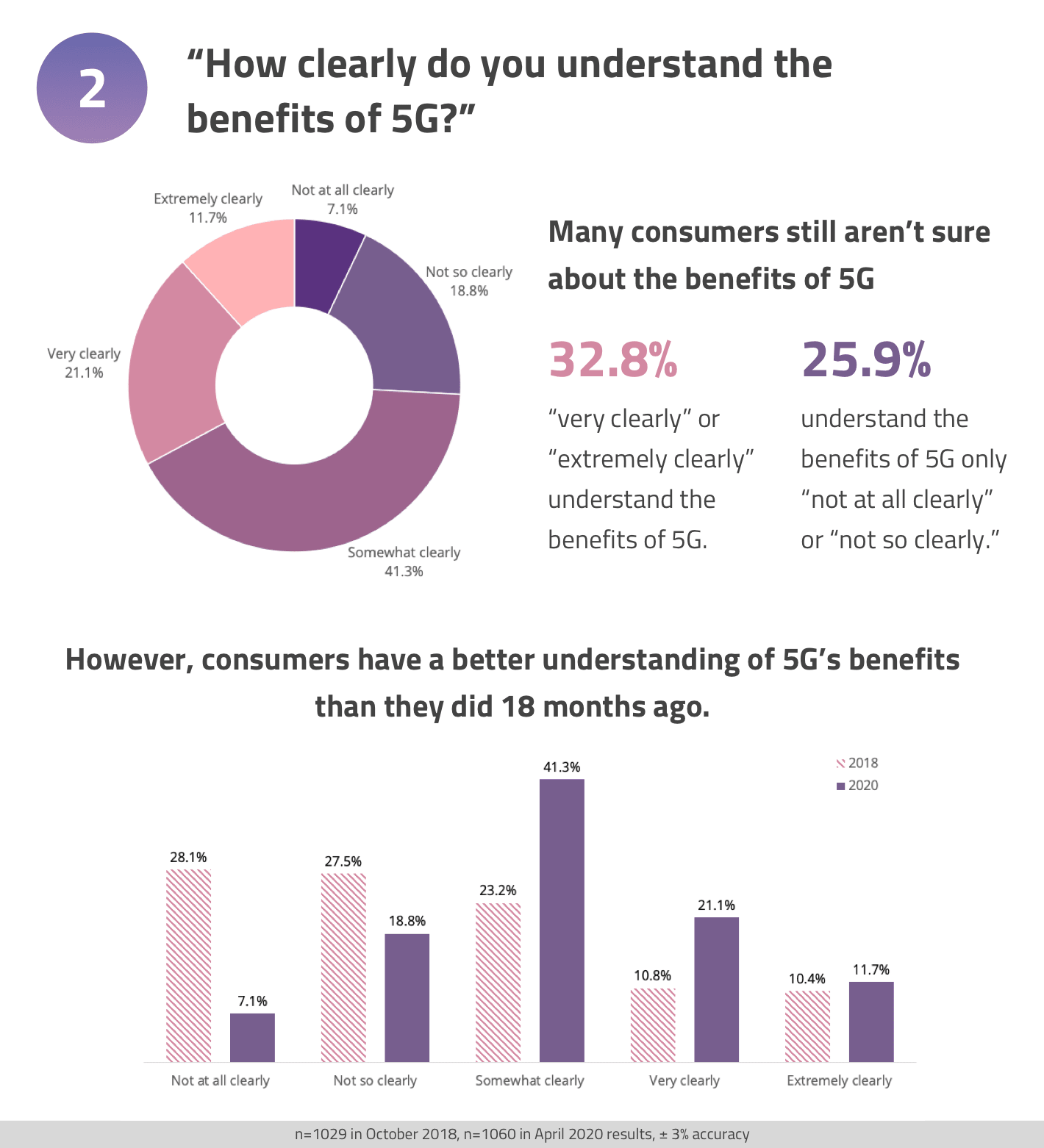

- AT&T stands to lose the most subscribers to a newly-merged Sprint and T-Mobile

- 28.8% of AT&T customers we polled are interested in switching to the New T-Mobile. Verizon is in a much safer position: 45.3% said they weren't interested in switching to New T-Mobile.

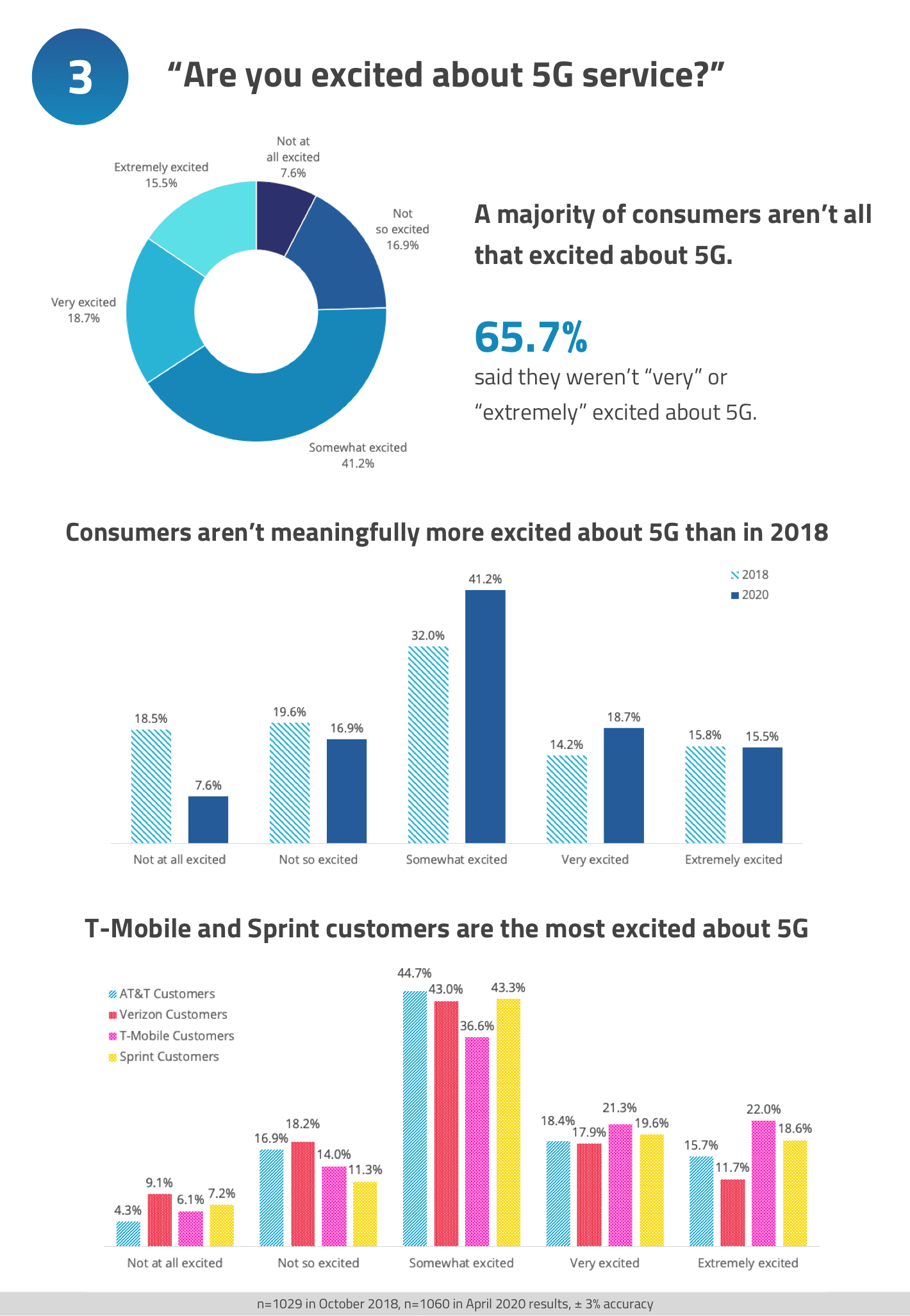

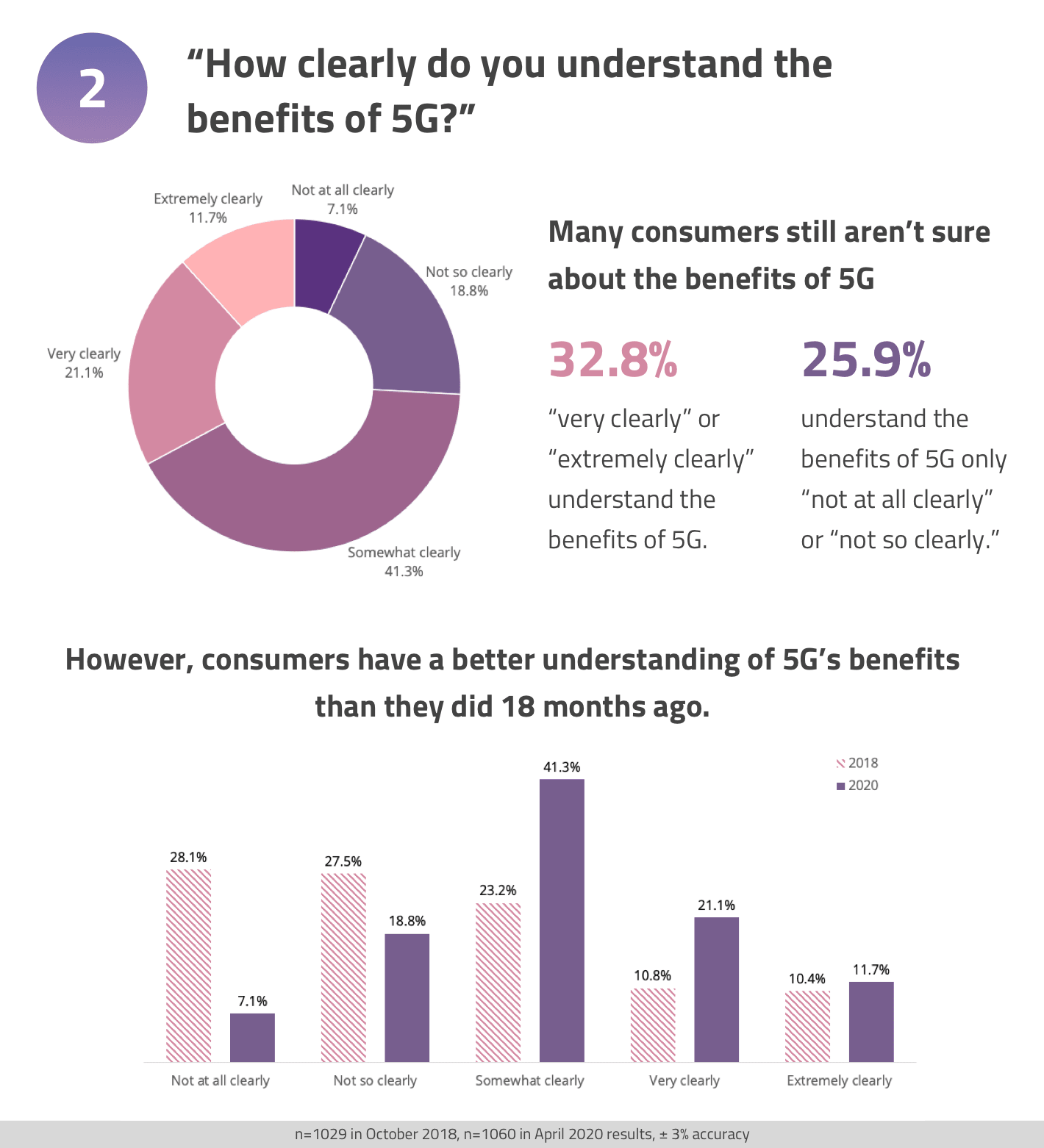

- Many consumers still aren't sure of the benefits of 5G

- Despite heavy 5G marketing, only 32.8% of consumers said they understand the benefits of 5G very clearly. This is an increase over the last time we asked this question in October 2018, but still represents a minority of users.

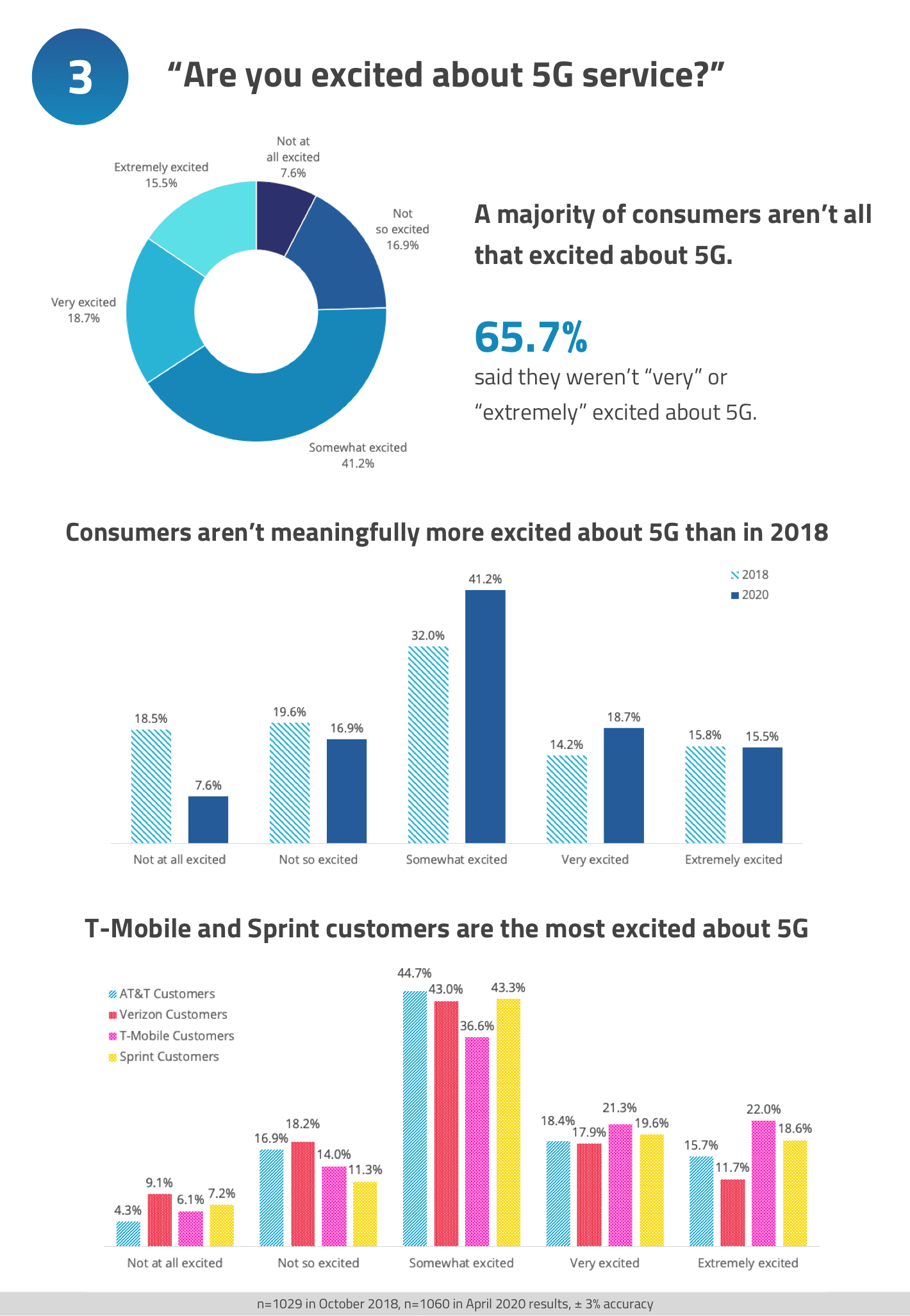

- Most consumers aren't very excited about 5G

- 65.7% of consumers said they weren't very excited about 5G. There was only a small increase in excitement about 5G compared to the last time we asked this question in October 2018.

- T-Mobile and Sprint customers are the most excited about 5G

- Our results show meaningfully higher excitement about 5G amongst Sprint and T-Mobile users - 22% of T-Mobile and 19% of Sprint subscribers reported being "extremely excited" about 5G, compared to just 12% of Verizon and 16% of AT&T subscribers

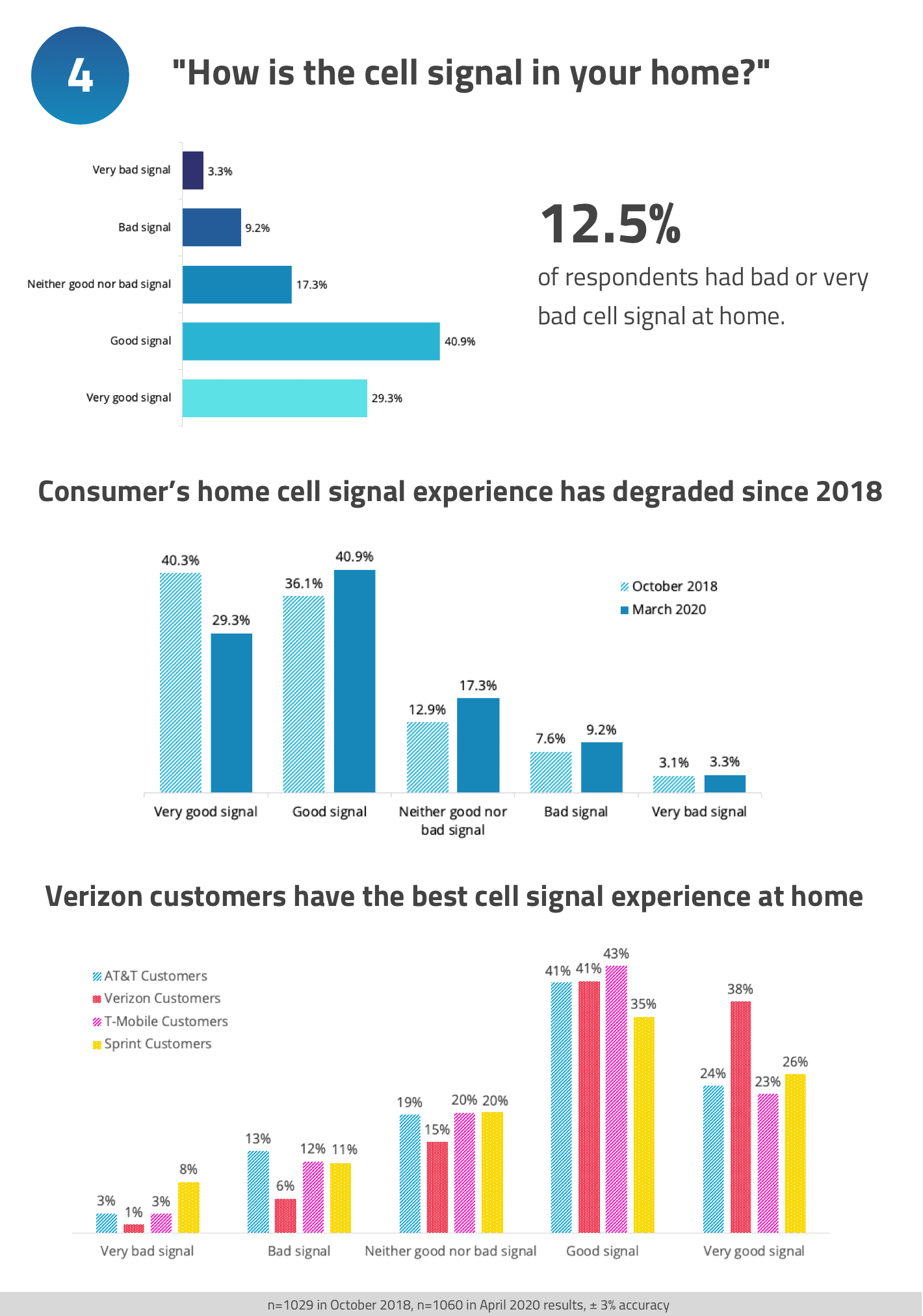

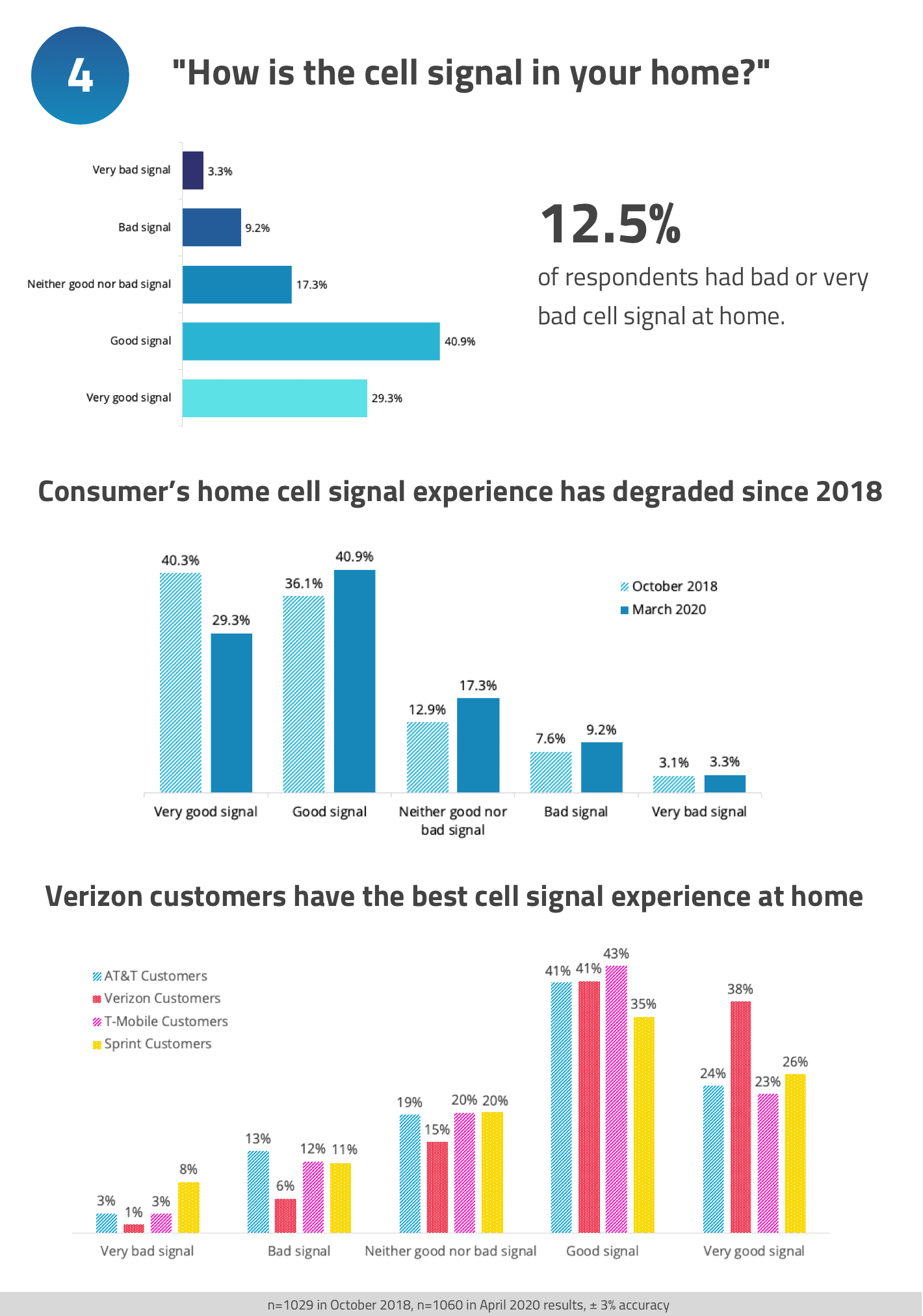

- US consumers rate their home cell signal as significantly worse than in 2018

- Only 29.3% of respondents reported very good cell signal at home, versus 40.3% when we asked the same question in October 2018. That's a large drop: clearly users' expectations of their cellular service are significantly outrunning network upgrades.

- Verizon has a significant lead in cell coverage experience

- 38% of Verizon subscribers reported having "very good signal" at home, compared to between 23% and 26% for Sprint, T-Mobile, and AT&T. A considerably lower percentage of Verizon subscribers reported having "very bad signal" or "bad signal" at home.

Survey Methodology

We commissioned an online survey of 1,065 American adults on March 30th by SurveyMonkey, using their gender and age-normalized panel to sample the wider American population. The results reflect a nationally representative sample with a confidence interval of 3% (except as noted, where only a subset of respondents were included). More information about SurveyMonkey’s survey methodology is available here.

About this Report

The US wireless industry is in a state of flux. The T-Mobile-Sprint merger represents the biggest overhaul in the competitive landscape of the US cellular market in at least a decade. At the same time, all the major carriers are rushing to deploy new 5G networks that promise faster data rates, lower latencies, and a dramatic expansion of cellular IoT devices.

We wanted to understand who stands to lose from the creation of the "New T-Mobile" and take the pulse of consumer's understanding and excitement about 5G. We'd asked many of these same questions in our September 2018 T-Mobile-Sprint Merger Report and our October 2018 5G report, which allowed us to compare this report's results to historical data.

About Waveform

Founded in 2007, Waveform is a leading online reseller of cell phone boosters, small cells, and a systems integrator of in-building active and passive distributed antenna systems. Over the last 13 years, Waveform has helped over 20,000 customers improve cell service in buildings of all sizes.

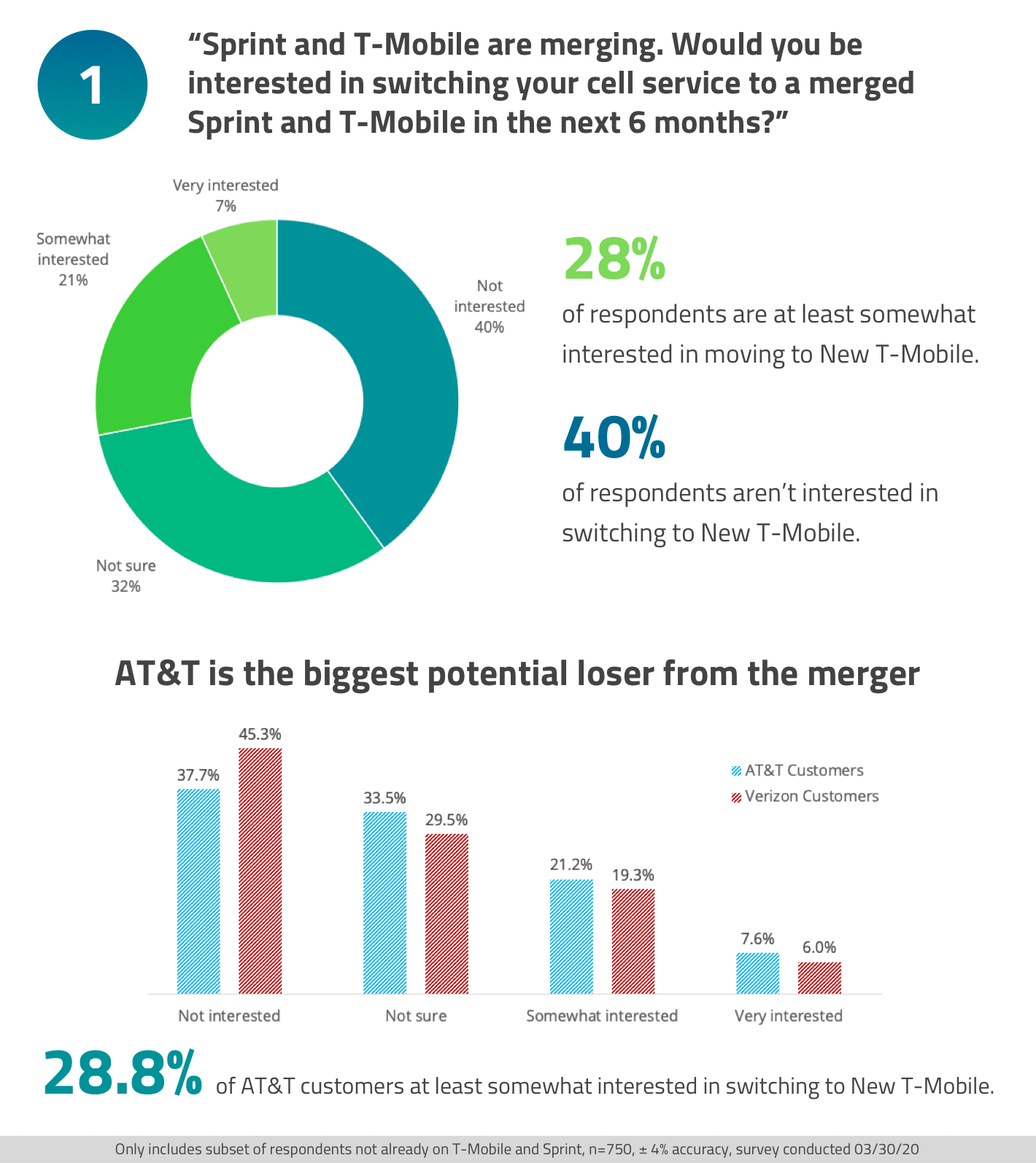

Part 1: T-Mobile Sprint Merger – AT&T Stands to Lose

After overcoming multiple regulatory hurdles, T-Mobile and Sprint have finally merged. T-Mobile was adding subscribers quickly even before the merger. In 2019 7 million new subscribers joined the network. We wanted to gauge interest from consumers in switching to the new network, and specifically to dig into the results to find out whether AT&T or Verizon subscribers were more likely to consider jumping ship to the New T-Mobile.

Of those who weren't already T-Mobile or Sprint subscribers, 7% were "very interested" and 21% were "somewhat interested" in moving to the New T-Mobile. While 40% of subscribers weren't interested at all, another 32% said they were "not sure." The latter is encouraging – at least some of those users might be swayable with the right plan offering.

Breaking out the data by carrier, we found that AT&T customers were considerably more swayable than Verizon customers. 45.3% of Verizon customers said they were not interested in moving to the New T-Mobile at all, whereas only 37.7% of AT&T customers said the same. As we'll see later, this may be at least partially due to Verizon's excellent in-building performance.

Part 2: Consumers Have a Better Grasp of 5G's Benefits, But Still Aren't All That Excited

All the major US carriers have been heavily touting their new 5G networks with large advertising campaigns. The major benefits of 5G are lower latency, higher data rates, and greater capacity. But the landscape is extremely confusing, with three different flavors of 5G, each with different levels of improvement over 4G LTE.

Here's a quick overview of the different versions of 5G offered today by each carrier:

- AT&T has 3 version of 5G. 5GE (the "E" stands for "evolution") is just a rebrand of existing 4G LTE and not true 5G at all. AT&T's 5G refers to 5G technology on their low-band 850 MHz spectrum, which shows slight improvements in performance for users over 4G LTE. Finally there's AT&T's 5G Plus, which refers to millimeter wave (mmWave) 5G that is being rolled out in urban areas and offers dramatic increases in data rates

- Verizon has been focused on mmWave 5G, which they call "Ultra Wideband 5G." Coverage is limited to urban areas, but where coverage exists, it offers huge improvements in speeds.

- T-Mobile is rolling out low-band 5G on their 600 MHz spectrum. This version of 5G offers slight improvements in performance compared to 4G LTE. While T-Mobile have licenses for 5G on mmWave frequency bands, they haven't started rolling it out yet.

- Sprint, unlike other carriers, hasn't been rolling out low-band or mmWave 5G. Instead, they've been rolling out the new technology on their huge swath of 2.5 GHz mid-band spectrum.

We asked customers how clearly they understood the benefits of 5G, and the results showed that the marketing is having at least some effect. Customers understand 5G better than before: 32.8% of respondents said they understand the benefits "very clearly" or "extremely clearly," compared to 21.2% who reported the same in October 2018.

However, overall, the majority of people have a hazy view of the benefits of 5G. 67.2% of respondents understood 5G "somewhat clearly," "not so clearly," or "not at all clearly." The results are hardly surprising given the alphabet soup of different varieties of 5G. And customer understanding likely hasn't been helped by AT&T's marketing-driven decision to rename recent 4G LTE network upgrades as 5GE.

While US consumers understand the benefits of 5G slightly better than when we asked the same question in 2018, their excitement hasn't increased in quite the same way.

65.7% of our panel of respondents said that they weren't "very" or "extremely" excited about 5G. That represents only a small change from our October 2018 poll, when 70.1% said they weren't "very" or "extremely" excited. Apparently a better understanding of 5G's benefits hasn't translated into customer interest.

Breaking the results down by carrier showed a clear divide: T-Mobile and Sprint customers are significantly more excited about 5G than Verizon or AT&T. 43.3% of T-Mobile subscribers and 38.2% of Sprint subscribers were highly excited about 5G, whereas just 29.6% of Verizon subscribers and 34.1% of AT&T subscribers reported the same.

Part 3: User's Report Home Cell Service Has Degraded Since 2018, Verizon Leads

We were quite surprised by this part of our report. Cell service is constantly improving as carriers upgrade their networks. However, it appears that consumer's expectations have outstripped performance improvements in the last 18 months.

Comparing the data in this report to our October 2018 survey, 11.0% fewer users reported having “very good signal” at home - a significant decline. Overall, users are significantly less satisfied with their cell signal at home compared to two years ago.

Digging into the data broken down by carrier, we find that Verizon has a significant advantage over the other carriers. 38% of Verizon subscribers reported having "very good signal" at home, and only 7% reported having "bad signal" or "very bad signal." If you're looking for the best cell signal at home, Verizon is clearly the right choice.

Further reading

Past Reports

Guides

At Waveform, we pride ourselves on writing the most detailed, technical guides on everything related to improving cell signal. Here are just a few of our most popular articles: